Becoming a freelancer has sometimes been publicized as living carefree as a bird in the sky. You see pictures of freelancers working on a beach or in bed in your pajamas. But is freelancing really free? Undoubtedly, being a freelancer has many perks, and location independence is one of them. However, there are many factors a fledgling freelancer must consider if they wish to make a lasting career.

One of them is to manage their expenses carefully. What costs do freelancers need to take into account when they start freelancing? Let’s see.

1. Physical Working Space

Many freelancers do not need real working space. They can work from the comfort of their home, from a coffee shop, or any other location with internet access. However, some need to meet with clients. They need to rent a commercial office. And the rentals vary a lot from one area to another. Some cheap options are using Coworking spaces or daily office rentals. If you know other freelancers in the same situation, you can share the rent and the office space and thus save on the bill. You will need to provide for all the expenses and hassles related to renting, negotiating, and paying.

2. Office Equipment

If you work at home, you will need a comfortable setup to have all you need to work and be efficient. The list includes an ergonomic chair you can sit for long hours without breaking your back or legs. You will need a suitable desk too and a lamp, for the late-night projects. Also, you need to consider any hardware like a printer, for example. And stationery – pencils, notepads, pens, paper, business cards, if required.

3. Laptop or Computer and Other Devices

Of course, you need to own at least a laptop if you are a freelancer. Then, according to your services and needs, you may require a desktop computer and a monitor. Designers might require a tablet to draw on. If you are customer support and need to take in incoming calls, you must purchase a good headset.

Based on your service and niche, you will need a different set of hardware. You will need to provide it for yourself. The good news is that they are usually last for several years, so you won’t need to replace them that often. You also can get a tax deduction for purchasing your hardware and supplies. Ask your accountant how to do it.

Related Posts:

4. Subscriptions and Licenses

You need to consider the software you will need to use for your freelancer services. If you are a translator, Trados, the go-to translator program, costs approximately 600$. Some software will cost you a one-time payment, while others come as a subscription. Some programs you may need include the Office 365, access to VPN – Virtual Private Network, Stock Photography providers, or Adobe’s Creative Cloud. If you are just starting and cannot face the costs, you have options. All these have alternatives in the open-source world. But consider it a temporary solution, as to be professional, you will need the best tools out there.

5. Publicity and Freelancer Platform costs

Freelancers need to find ways to reach their clients. They need to market their services in a way that they find new clients. They can do that using Social Media ads on LinkedIn or Facebook, Twitter, or Instagram. Google pay-per-click ads are another option.

Consider the payment for freelancing platforms as Upwork too. Services such as Upwork or Freelancer allow you to have your profile free. However, some platforms charge money if you want to bid on projects. They also get a fee from the project’s worth of sometimes up to 20%.

6. Professional Website

Some freelancers, for example, designers, need a well-built professional website. They need it to feature their work and attract prospective clients. Even if your website has not had many extra perks, you need to consider all the costs of having a website. They include subscriptions for hosting and domain. Development and design costs are also quite expensive unless you build it using WordPress.com or Wix.com. If you want to have a blog on your site, you will need to hire a copywriter.

7. Taxes and Accountant

Unlike employees, freelancers need to manage their invoices and tax themselves. The rate of self-employment taxes is usually about 15%.

Unless you have the skills to lead your accounting, you need to hire a good accountant who will book your activity as a freelancer. Accounting services for freelancers depend on your country and region, but you can find affordable options in most cases.

8. Paying your Health Insurance

Freelancers face medical costs too, and they need to allot a part of their budget for good health insurance and other health expenses.

Choose the option that works for you best. You can ask your accountant to help you find good health insurance for your needs.

9. Retirement Plan

Freelancers need to provide for their retirement too. They must save money on their own or make sure they pay taxes related to retirement. Plan with your financial advisor the best solutions for your future financial stability.

10. Professional Development

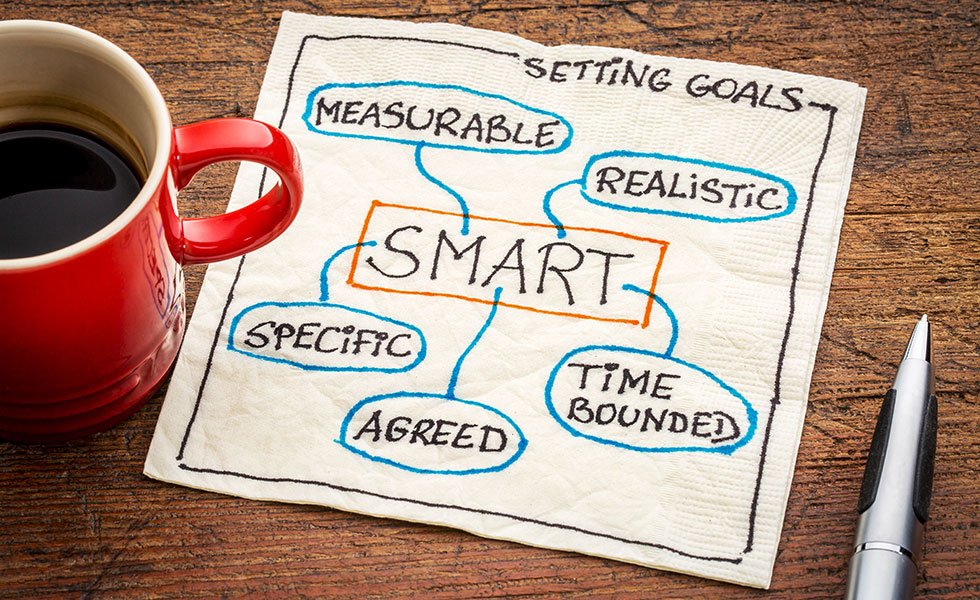

As a professional freelancer, you need to constantly learn and grow in your chosen niche. This way you can keep up with the latest trends and develop their skills. Freelancers need to be very conscious about choosing a development program. Is it going to pay off more than it costs? Is it worth it?

If you are starting your business, you may consider some programs at a relatively low cost or free of charge.

11. Vacations and Sick Leave

Freelancers can take time off, but it is not paid, unlike employees. You definitely should plan time to recharge your batteries and take good care of yourself as a freelancer, especially if you are not feeling well.

Set aside a portion of your monthly income for your coming vacation and travel expenses. You need to do the same for sick time. One strategy many freelancers do is saving 10% out of each completed project. They put it into a separate account that they do not touch. This saving account is convenient when vacation time, or time of crisis, comes.

In the long run, it is a good practice among freelancers to keep up to 6 months of living expenses. Just in case you won’t be able to work, or you will need to face an unexpected loss of clients, you will be safe.

In Conclusion:

Before moving to a full-time freelance career, calculate your expenses very well. This will guarantee your success and sustainability over time.

How was your experience with facing all these freelancer costs? Have you managed to have all of them in check? We’d love to hear about your experience.